Do you use prescription medication more than 12 times per year? Plan to use HRT and want to save a little money?

You may benefit from an NHS Prescription Prepayment Certificate (PPC).

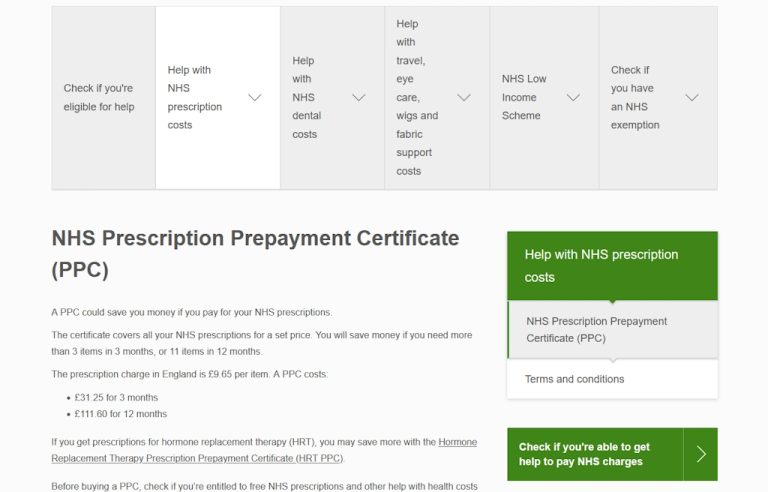

What is the NHS Prescription Prepayment Certificate?

The NHS PPC is a season ticket for those who need to buy a lot of prescriptions. It’s a yearly certificate that entitles you to pre-pay for prescriptions and can save you a lot of money.

There’s a standard NHS Prescription Prepayment Certificate that costs £31.25 for 3 months or £111.60 for 12 months and pays for all your meds for that year.

There’s also a specific NHS Hormone Replacement Therapy Prescription Prepayment Certificate (HRT PPC) for women who want to pre-pay for HRT treatments.

All you need to do is buy a certificate and present it whenever you’re collecting prescriptions from the pharmacist.

The certificate can be in paper or digital form and will simplify the entire process by removing the need to pay every time you collect drugs.

Save money while still getting your medication

The NHS PPC can also save you money.

At current prices, if you buy a 12 month PPC and use it for 12 medications, you’ll save £4.20 a year.

The more prescriptions you use, the more you’ll save.

As the most you’ll pay is £111.60 at 2023 prices. That’s the maximum you’ll pay for all your prescriptions that year.

If you use many more than 12 prescriptions, you’ll still only pay the £111.60.

That could work out much cheaper for someone on multiple medications either permanently or temporarily!

It’s proving a very popular scheme so if you need regular medication and spend more than the cost of a certificate per year, it’s well worth getting one!