Creating a household budget is the cornerstone of financial management. Whether you’re dealing with family finances or a billion pound organisation, if you don’t know what’s coming in or going out, you have no idea what’s going on.

That not knowing makes any financial planning much more difficult than it has to be.

Rather than using data-driven decision making, we’re guessing and just won’t do. Not when it comes to finance.

Fortunately, you don’t need a team of accountants or complicated software programs to create a household budget.

You can use a free spreadsheet like Google Sheets and an hour or so of your time.

By the end of that hour, you’ll have a clear idea of what you have coming in and going out.

Every financial decision you make from then on can be based on data rather than guesswork.

That’s the best way to make financial decisions.

Creating a household budget

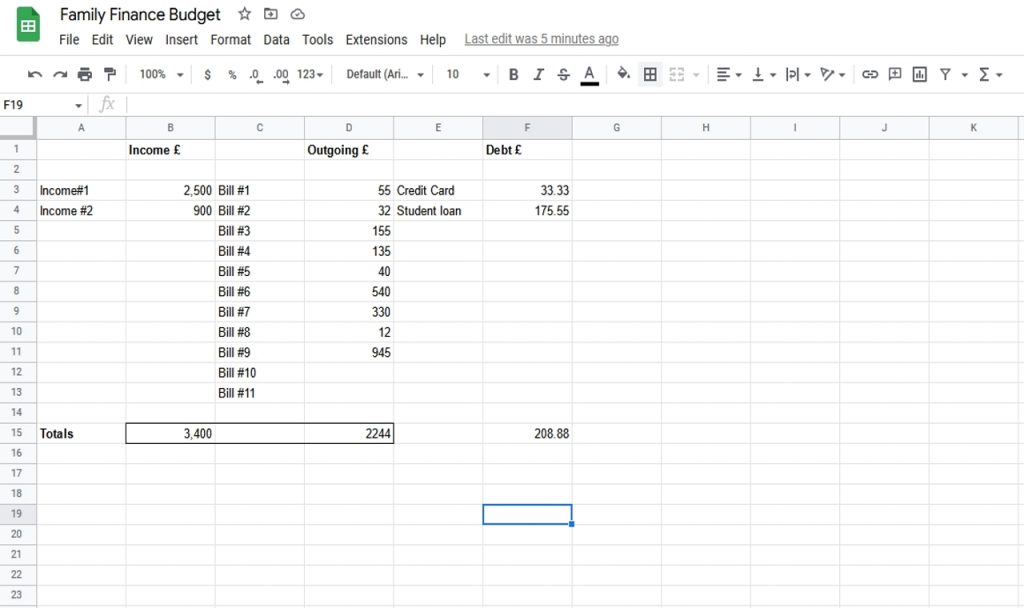

There are lots of spreadsheet examples online but I prefer to keep it simple. One column for income, one for outgoings and another for debt.

Here’s how to do it.

- Open a new Google Sheet and call it something meaningful

- Give column B a heading of Income

- Give column D a heating of Outgoing

- Give column F a heading of Debt

- Add all your income into column B with a label in column A so you know what it is

- Add all your outgoings into column D with a label in column C so you know what it is

- Add all your debts to column F with a label in column E

- Select a row under where your entries end for the totals

- Select a cell under column B for totals, select Insert > Function > SUM

- Select all cells in column B where there’s data and press Enter to include them in the sum

- Select a cell under column D for totals, select Insert > Function > SUM

- Select all cells in column D where there’s data and press Enter to include them in the sum

- Repeat in column F for debt

What you should end up with is all your income, outgoings and debts with totals at the bottom showing you exactly what’s coming in and going out.

Make sure to include all regular outgoings, no matter how small. Update them as they change and keep an eye on amounts.

You’ll probably be able to identify subscriptions or payments you no longer need to make so can make instant savings.

I would recommend ordering debt so the highest interest is at the top and add a column showing interest rate.

That way, you can prioritize paying off the most expensive debt first.

Managing your household budget

Now you have a basic household budget, you can predict how much money you have left, how much you can put into savings and identify any areas you can cut back.

The budget is flexible, so as entries change, you can add amounts, change rows and keep it so it reflects your current situation.

Once you have the budget in place, your financial situation becomes much clearer. You have a better idea of where you are financially and whether you have space to save or whether you need to make cutbacks.

Either way, you’re making decisions based on data rather than guesswork. That can make a huge difference to what comes next!